Why Financial Preparation Is Important For Women

Why Financial Preparation Is Important For Women

Blog Article

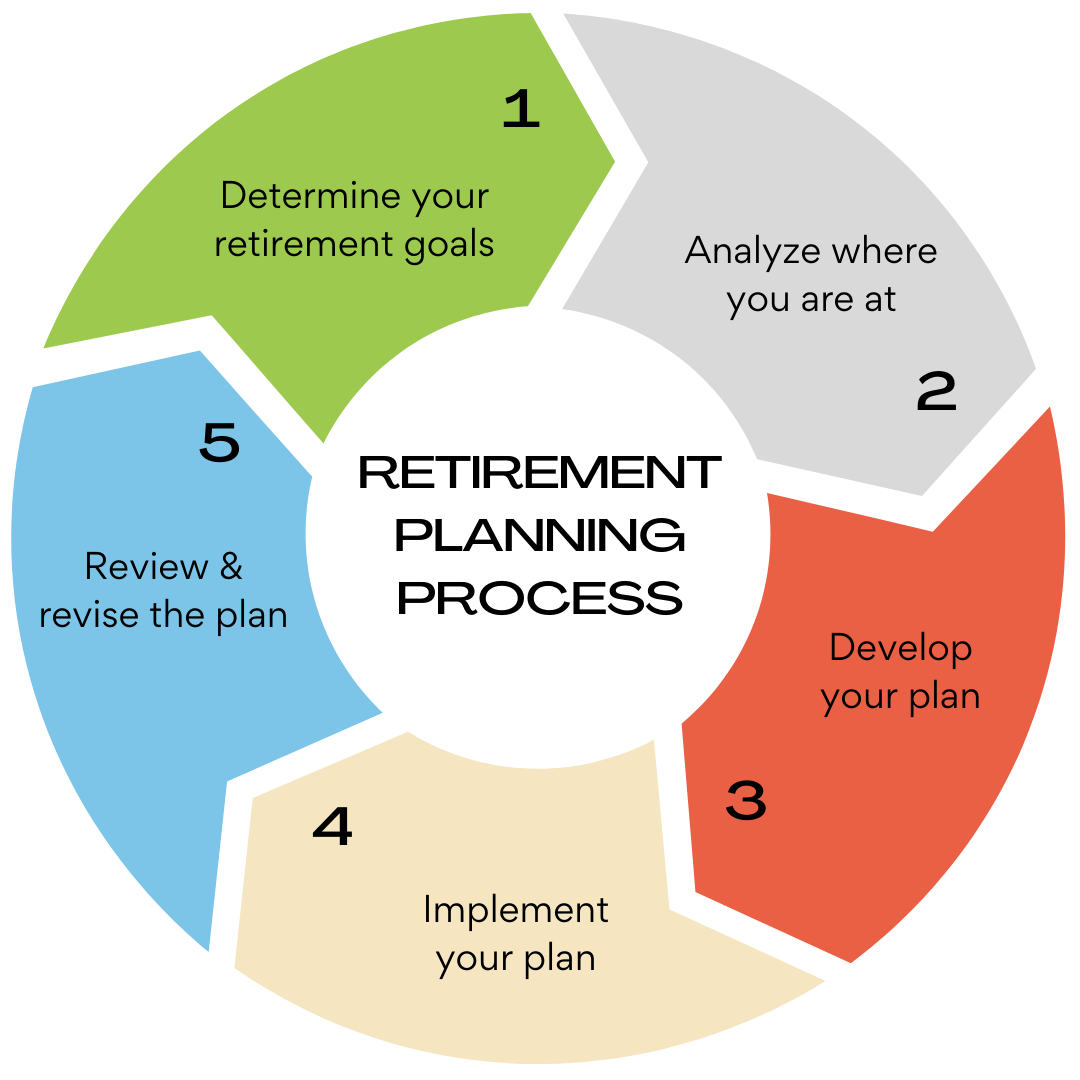

For me, a retirement planning layperson, there are 10 steps you need to require to complete a reasonably beneficial retirement strategy. Each step builds upon the other up until you lastly get to a list of actions that provide you a much better chance of having the kind of retirement way of life you are hoping for. In this article, I will present ten actions to establish a decent plan.

Establishing a retirement strategy and conserving for your retirement might be several years away for you but, if you start early, especially in your twenties and thirties and do that till you retire in your fifties and sixties, you'll have a a lot more comfy retirement than your female counterparts who didn't conserve anything and now are depending on the federal government to assist them out.

The clearer you have to do with what you desire for your future, the simpler it will be for you to make choices about financially preparing for your retirement. To start, think about the following ingredients while you are baking your retirement cake.

When you invest toward retirement planning, you utilize the guideline, "the more youthful you are, the more threat you must take." Because the peaks and valleys of the stock market is the riskiest area, this indicates that at age 20 to 30, you should have about 80-90 percent of your funds in stocks with the balance divided in between bank products and bonds. If you're investing in tax-deferred instruments, such as a 401-k, choose those options. Even though the marketplace may drop, it does not indicate you have actually lost money, it just suggests that you have actually acquired stocks at a lower rate. You do not lose funds unless you offer.

By keeping tabs on your spending you will find out just how much, usually, it costs you to live. This will help you see if you are saving enough to keep your way of life in retirement and, if not, what you can do to repair the problem.

Do not fall under the trap of retiring to do nothing. Your retirement will not be any different than work. You need to set and pursue retirement objectives.

Along the same lines of expenditures of homes, cars, and boats, you require to determine what other needs you might have at retirement. A good consideration is that health care costs are climbing up, and are approximated to reach soaring levels during your lifetime.

If none of the above discussed options have actually been made available to you, then it is better to produce an IRA with the nearest bank. The procedure of opening an IRA has actually been streamlined greatly and supplied you furnish them with the needed files, the whole process is going to be a breeze. Practically all of the users will welcome the tax-deferred growth of earnings. Choosing a Roth individual retirement account has actually likewise been discovered to be effective in certain cases for certain people. From all retirement activities of these it can be discovered that it is entirely as much as our hands whether to make or break a retired life. Invest wisely and live well, the benefits will be terrific.